- Site Registration

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmers Almanac

- USDA Reports

Halliburton Stock Outlook: Is Wall Street Bullish or Bearish?

With a market cap of $18.1 billion, Halliburton Company (HAL) is one of the world’s largest providers of products and services to the energy industry. Operating through its Completion and Production, and Drilling and Evaluation segments, the company delivers a broad range of solutions for oilfield exploration, development, and production.

Shares of the Houston, Texas-based company have underperformed the broader market over the past 52 weeks. HAL stock has declined 31.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 21.1%. Moreover, shares of Halliburton are down nearly 22% on a YTD basis, compared to SPX's 7.9% gain.

Looking closer, shares of the oilfield services company have also lagged behind the Energy Select Sector SPDR Fund's (XLE) 2.6% dip over the past 52 weeks.

Shares of Halliburton recovered nearly 1% on Jul. 22 after the company reported Q2 2025 revenue of $5.5 billion, beating estimates despite a 5.5% year-over-year decline, while EPS of $0.55 matched expectations. Investors were encouraged by stronger-than-expected international revenues of $3.3 billion, robust cash flow generation of $896 million, and solid free cash flow of $582 million. Additionally, Halliburton’s $250 million in stock buybacks and continued focus on shareholder returns helped offset concerns around weaker North American results and declining segment profits.

For the fiscal year ending in December 2025, analysts expect HAL's EPS to drop 28.4% year-over-year to $2.14. The company's earnings surprise history is mixed. It met the consensus estimates in three of the last four quarters while missing on another occasion.

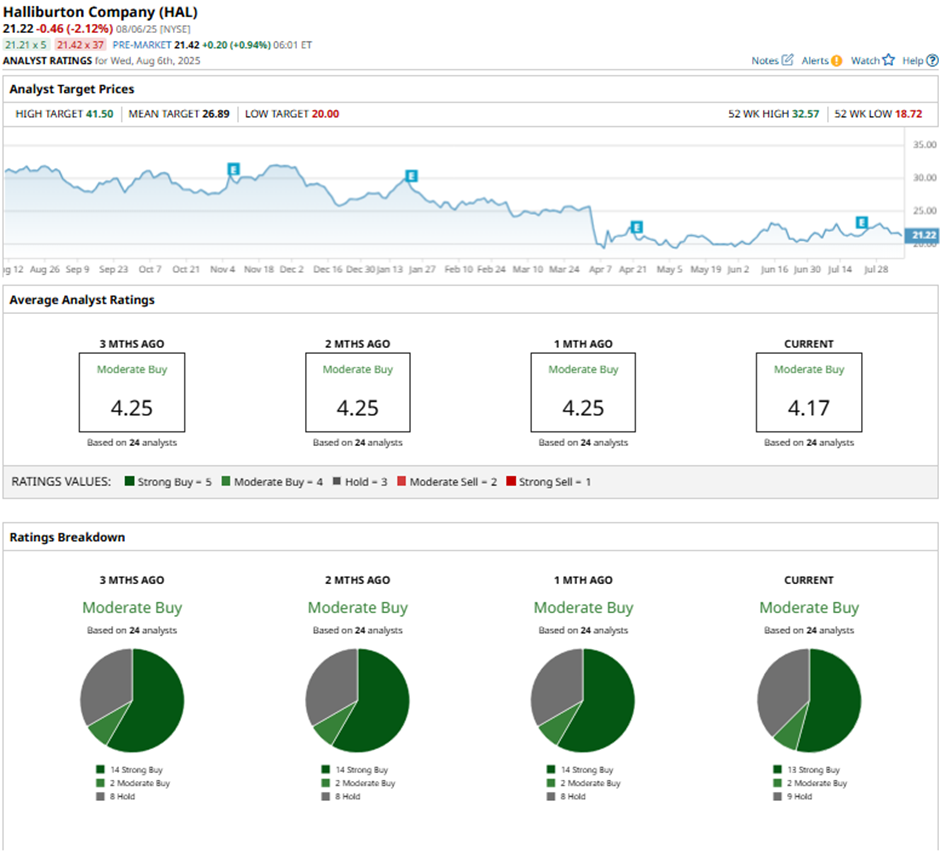

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, two “Moderate Buys,” and nine “Holds.”

This configuration is slightly less bullish than three months ago, with 14 “Strong Buy” ratings on the stock.

On Jul. 23, Wells Fargo analyst Roger Read cut Halliburton’s price target to $26 and maintained an “Overweight” rating, citing a recovery expected from the first half of 2026.

As of writing, the stock is trading below the mean price target of $26.89. The Street-high price target of $41.50 implies a potential upside of 95.6%.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.