- Site Registration

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmers Almanac

- USDA Reports

Are Wall Street Analysts Bullish on Medtronic Stock?

/Medtronic%20Plc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Headquartered in Galway, Ireland, Medtronic plc (MDT) develops, manufactures, and sells device-based medical therapies. With a market cap of approximately $115 billion, the company derives revenue from four core segments: Cardiovascular Portfolio, Medical Surgical Portfolio, Neuroscience Portfolio, and Diabetes.

MDT stock has surged 10.6% over the past year, trailing behind the S&P 500 Index ($SPX), which surged by 21.1% during the same period. However, year-to-date, MDT stock has advanced by 11.9%, outpacing the S&P 500’s 7.9% gain.

Focusing on the industry, MDT has surpassed the S&P Healthcare Equipment SPDR’s (XHE) decline of 8.3% over the past year and a 13.3% drop year-to-date.

On July 21, Medtronic announced that it had received CE Mark approval for its MiniMed 780G insulin delivery system. The market initially responded cautiously, but by the next trading session, shares had risen by nearly 2.2%.

For the current year, ending in April 2026, analysts anticipate MDT to achieve EPS growth of 1.1%, reaching $5.55 on a diluted basis. Notably, Medtronic has consistently beaten consensus estimates over the past four quarters.

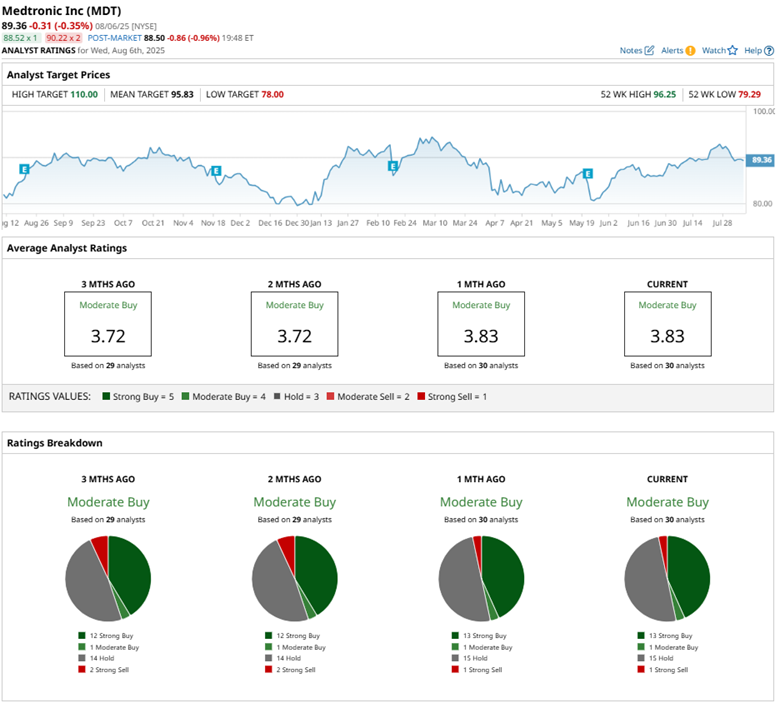

Among 30 analysts covering MDT stock, the consensus rating is a "Moderate Buy," comprising 13 "Strong Buy" ratings, one "Moderate Buy," 15 "Holds," and one “Strong Sell.”

The current analyst sentiment is slightly more bullish than two months ago, when MDT had a total of 12 "Strong Buy" ratings.

On Jul. 16, Mizuho Financial Group, Inc.’s (MFG) Anthony Petrone raised his price target from $98 to $100, while maintaining an “Outperform” stance. He believes Medtronic is well-positioned within the medical technology sector.

Similarly, on Jul. 15, Morgan Stanley (MS) bumped its price target from $98 to $107, reaffirming its “Overweight” rating. The firm sees continued relative stability in procedure volumes and capital spending trends across hospitals as a reason to stay constructive on the industry, and on Medtronic in particular.

The mean price target of $95.83 represents a 7.2% premium to MDT’s current price levels. Meanwhile, the Street-high price target of $110 suggests a potential upside of 23.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.